Stock option tax calculator

Exercising your non-qualified stock options triggers a tax. Taxes for Non-Qualified Stock Options.

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

IRS YouTube Videos.

. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. If the stock price rose to 20 per share the employee could exercise the options for 1000 then sell the 100 shares for 20 per share or 2000. Income Tax Calculator in excel for FY.

Treasury Stock Method Calculation of Diluted Shares. The American Opportunity credit is the preferable option for students enrolled in four-year colleges. Delta is on a scale from 100 to -100.

Usually taxable Non-qualified Stock Option transactions fall into four possible categories. 2017 FRANCHISE TAX CALCULATOR 2018 FRANCHISE TAX CALCULATOR MS Excel format is required for use of this calculator This calculator can only be used to calculate stock that has par value. We can then subtract the 5000 shares repurchased from the 10000 new securities created to arrive at 5000 shares as the net dilution ie the number of new shares post-repurchase.

Federal tax State tax medicare as well as social security tax allowances are all taken into account and are kept up to date with 202223 rates. Please tick this option if you or your spouse were born before 6 April 1935. Delta measures the rate of change of the theoretical option value to changes in the underlying assets price.

The 1012 Tax Bracket. Technology FlyFins 1099 Tax Calculator makes it easy for 1099 self-employed individuals to compute their quarterly or annual income taxes owed quickly. WASHINGTON With tax reform bringing major changes for the year ahead the Internal Revenue Service today urged retirees to make sure they are paying in enough tax during the year by using the Withholding Calculator available on IRSgov.

Your household income location filing status and number of personal exemptions. Vega for this option might be 003. Calculate the taxes for your corporation LLC LP or non profit today.

Gamma is the measurement of the rate of change of the Delta. For instance lets say that a company has 100000 common shares outstanding and 200000 in net income in the last twelve months. San Jose CA August 16 2022 FlyFin a fintech provider unveiled a free 1099 income tax calculator ideal for individuals who receive 1099 Forms.

Cost of Preferred Stock Calculator Excel. Based on the most probable outcome which is highly subjective youll need to make adjustments as seen fit eg. Common examples include gains from short stock and security trades or flipping real estate.

In other words the value of the option might go up 003 if implied volatility increases one point and the value of the option might go down 003 if implied volatility decreases one point. Deep-in-the-money options eventually move dollar for dollar with the underlying stock. Although the option to not consider state tax is given.

Determine the total of your Delaware Franchise Tax with our Franchise Tax Calculator. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. If the total gross assets andor issued shares equal zero then please contact Franchise Tax at 302 739-3073 option 3.

Under the Tax Cuts Jobs Act which took effect in 2018 eligibility for the. Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary. Federal Income Tax Calculator 2022 federal income tax calculator.

That means youve made 10 per share. For people in the 10 or 12 income tax bracket the long-term capital gains rate is 0. Your Estimated Tax Using the Assumed Par Value Method.

When dealing with preferred equity with convertible features the security could be broken into separate debt straight-debt treatment and equity conversion option components. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Taxes are unavoidable and without planning the annual tax liability can be very uncertain.

You can also get knowledge about the taxes applied to your winnings using a lottery tax calculator. Powered by FlyFins proprietary AI. Or the employee could hold the shares and hope that the stock price rises even more which would make the stock options more profitable.

You exercise your option to purchase the shares and you hold onto the shares. Alabama state tax on lottery winnings in the USA. So if you have 100 shares youll spend 2000 but receive a value of 3000.

You exercise your option to purchase the shares and then you sell the shares the same day. For example a 30-day option on stock ABC with a 40 strike price and the stock exactly at 40. 2022-2023 select better option from Old regime vs new regime of taxation us 115BAC for Individual HUF Individual and HUF has to choose any one option out of two options for paying income tax for FY.

When the shares sold were acquired via stock compensation the cost-basis reporting is. Note calls and puts have opposite delta signs. Then they can choose to invest it into a retirement plan or the other stock option to generate a return.

So theyd make 1000 in profit. Form a Company Now. IR-2018-180 September 7 2018.

Our Tax and National Insurance NI calculator will provide you with a forecast of your salary as well as your National Insurance Contributions for the tax year of 202223. Click here for a 2022 Federal Tax Refund Estimator. Reporting Stock Sales On Your Tax Return - 403 IRS Form 1099-B Form 8949 and Schedule D are key forms to understand for proper reporting of stock sales on your tax return.

The main benefit of a lump sum is getting complete access to the funds. Estimated Tax Payments English Spanish ASL. How you report your stock option transactions depends on the type of transaction.

Lets say you got a grant price of 20 per share but when you exercise your stock option the stock is valued at 30 per share.

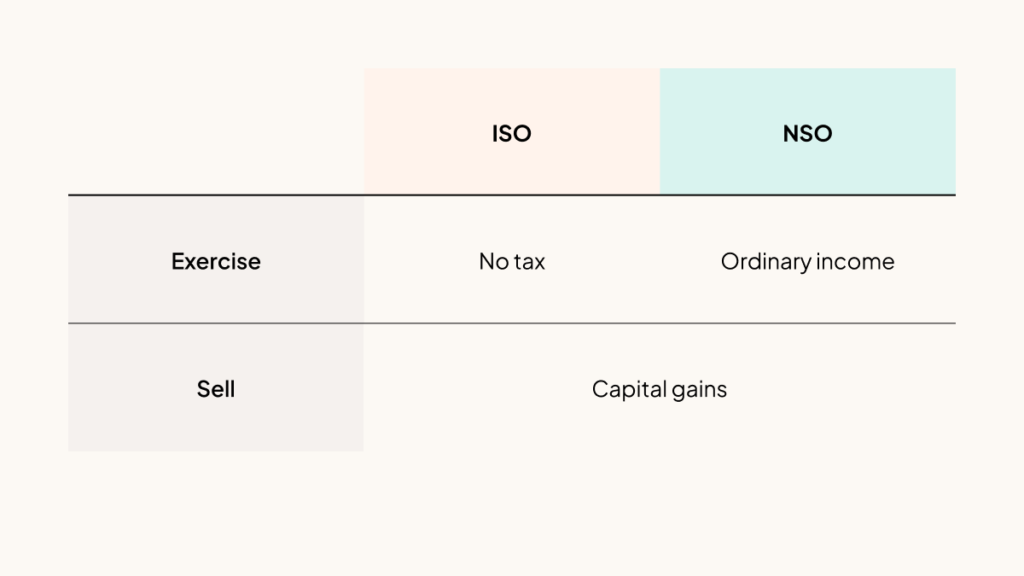

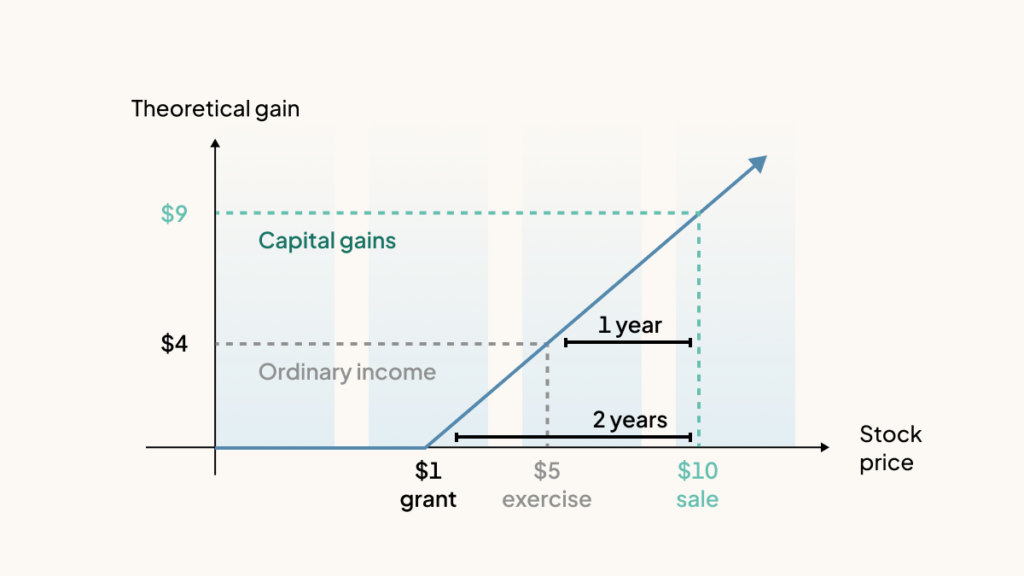

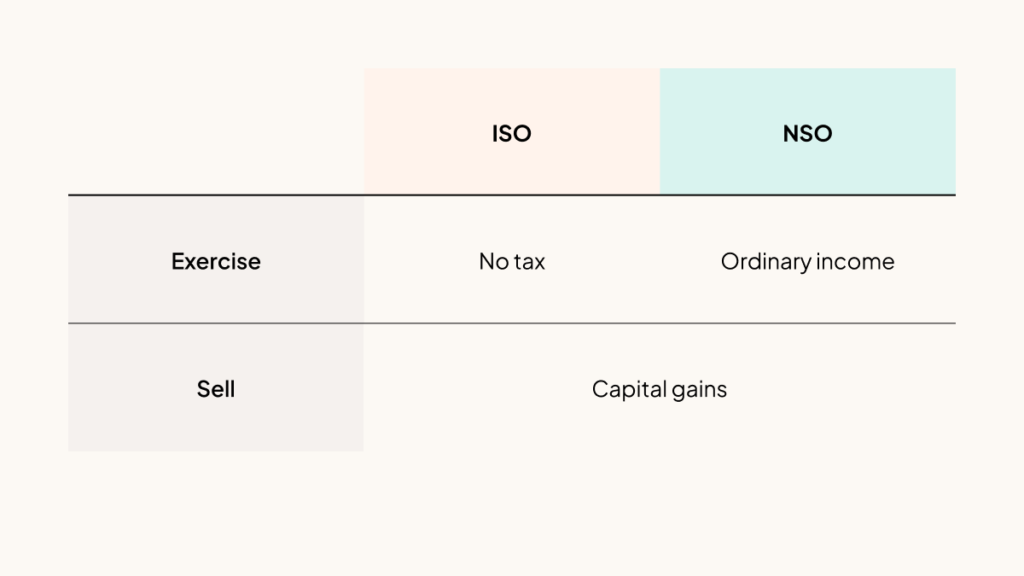

How Stock Options Are Taxed Carta

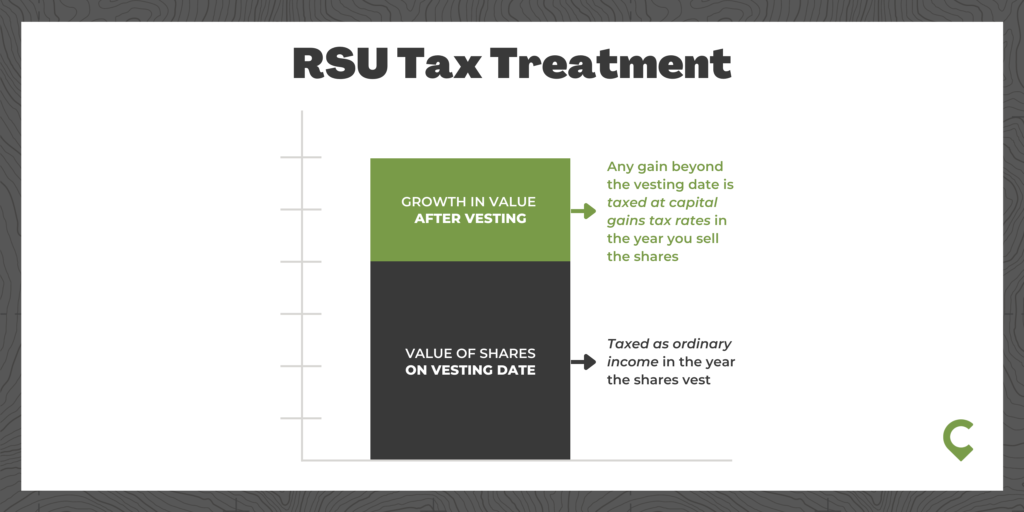

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

How Stock Options Are Taxed Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-05-8fa7cd6f867d4f82b34b0298f366c079.jpg)

Employee Stock Options Esos A Complete Guide

How Stock Options Are Taxed Carta

Federal Income Tax Calculator Atlantic Union Bank

Understanding How The Stock Options Tax Works Smartasset

Employee Stock Options Esos A Complete Guide

Understanding How The Stock Options Tax Works Smartasset

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

/employeestockoption_definition_final_0817-372c2669a3a54015a7bfa4eb6e884649.png)

Cijvp1txl9 Qsm

Amt And Stock Options What You Need To Know Brighton Jones

U9f7vmjpnzvc8m

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

Employee Stock Options Esos A Complete Guide

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options